2020 Vision: What do we need to plan for now?

In the midst of the COVID-19 pandemic, we are faced with the challenge of planning for the future with limited knowledge of what that future will look like. We have recently analysed future life sciences trends and context to inform the development of a long-term strategy for one of our clients. We would like to share this information to stimulate dialogue about how we can all work together to ensure UK life sciences and our health system continue to thrive.

Building on existing research, we have described some of the most important changes that will affect life sciences and the NHS. We will be sharing our synthesis of future trends in a short series, beginning with the following summary:

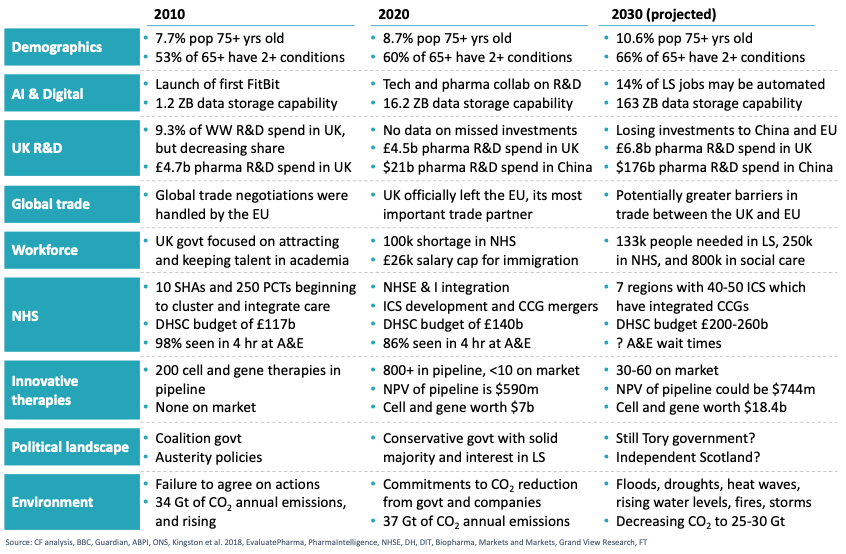

Demographics: Continuing previous trends, the UK population will continue to age, with 10.6% of the population predicted to be 75 years or older by 2030. Our elderly population will also become increasingly more complex as multimorbidity among 65+ years rises; we projected 66% of 65+ year olds will have two or more conditions (e.g. diabetes, heart disease, obesity) by 2030, up from 60% in 2020.

AI & Digital: Data capabilities will continue to rapidly expand, reaching 163 ZB storage capacity and creating new possibilities in life sciences and health. Data, AI, and digital technologies will make R&D more efficient, improve our understanding of disease, and enable the delivery of more personalised care. Health systems will be able to improve population health management, deliver specialist care more efficiently, redesign clinical pathways, and use AI-enabled decision support to apply best practice and better plan care for populations.

UK R&D: The pharmaceutical sector is the largest single investor in UK R&D and will play a critical role in achieving the UK government’s 2.4% target. Assuming growth in global pharma R&D expenditure and the UK share of global pharma R&D remain the same, we projected the pharma will invest £6.8bn in R&D in the UK. However, the UK risks losing investments as other markets become increasingly attractive. We have previously studied the effects of the UK’s decreasing share of global pharma R&D expenditures, which would cost the UK economy billions if the trend continues.

Global trade: Trade negotiations with the EU, the US, and other countries will be essential to the future success of the UK economy and health system. Medicines were the third largest export and second largest import for the UK in 2018, and trade agreements will need to ensure easy movement of medicines and health equipment. Changes in its relationships with other countries also presents the UK some unique opportunities, such as the potential to lead in innovative regulatory approval and IP laws.

Workforce: The well-documented shortages in the NHS and social care are projected to continue over the next decade. The NHS is expected to have a staff shortage of 250,000 by 2030, up from 100,000 today. Because of the ageing population, up to 800,000 more workers may be needed in social care by 2035. Life sciences will also require 130,00 more staff across R&D, manufacturing and supply, and many will now need tech expertise.

NHS: The NHS will continue to work towards achievement of its Long Term Plan, although short and medium-term priorities may be shifted to overcome the challenges presented by the COVID-19 pandemic. All of England will be covered by Integrated Care Systems in the future, with continued focus on linking primary, secondary, and community care. Assuming the NHS budget rises in line with projected GDP, the NHS budget will grow to over £180bn by 2030. However, to maintain current quality and types of services, the NHS may actually require over £240bn. The budget for adult social care is projected to rise to £20bn, but may experience a funding gap of £9bn due to increasing pressures.

Innovative therapies: After decades in the pipeline, gene and cell therapies are predicted to begin to realise their potential in the coming years. Over 800 gene and cell therapies are being investigated in the discovery and development, preclinical research, or clinical trials stages. It is expected that 30-60 gene and cell therapies will be on the market by 2030, which health systems will need to prepare for now.

Political landscape: Political parties and their agendas will continue to influence the NHS, social care, and life sciences. Each party will have different ideas about how to deliver the best care to the UK population at the lowest cost. We can only begin to understand how the 2019 election, exit from the EU, and the COVID-19 pandemic will affect health and life sciences policies and budgets across the UK.

Environment: Rapid transformation across every sector, including health and life sciences, will be necessary to combat climate change. The pharmaceutical industry emits more CO2 than the automotive industry and must reduce CO2 emissions by 59% to meet Paris Climate Goals. Health systems and life science companies will need to overhaul operating procedures to reduce CO2emissions, water pollution, plastic usage and waste production.