1. How can Lifesciences Partner Effectively with ICSs?

Many life sciences organisations – including the pharma, biotech, medtech and medical devices industry (Life Sciences) – engage effectively with the NHS to deliver ground-breaking technologies that improve patients’ lives. A prime example of this is the herculean collaboration between the UK government, NHS and life sciences industry to develop and deliver millions of doses of COVID-19 vaccines across the country.

Each year the NHS spends £24B on pharmaceutical products and £8B[1] on medical devices, equivalent to around 15% of the total NHS budget. For many companies, the NHS represents their only market in the UK, and single largest customer globally.

In April this year, the Health and Care Act 2022 – that creates Integrated Care Systems (ICSs) in law – received Royal Assent. On 1 July 2022, NHS England (the NHS) will devolve many of its powers and decision-making capabilities to 42 local NHS integrated care boards (ICBs) at which point clinical commissioning groups (CCGs) will be abolished.

This is a significant change to the nationally led model to pivot onto modern healthcare’s ‘big questions’ including how to better meet the needs of an ageing population and chronic disease locally and how to provide easy access to preventative care in the community. Fully integrated care systems like ICSs may be able to better address these issues more as they begin to focus on health across a local population of typically between 1 and 3 million people and further down to place and neighbourhood levels. To enable this, the NHS will move to devolve control over care planning and finance to the local delivery level.

Life Sciences should understand how to engage with these new bodies to create collaborations that create value for both Life Sciences and the NHS. Because of these devolved powers and budgets, the changes will affect the way Life Sciences deliver value to the market. Strategically, Life Sciences should begin to reimagine a way to create win-win collaborations that go beyond traditional transactions or token ‘sponsorships’ and add significant value. For example, this might be by partnering with ICSs to develop better treatment pathways, improving adherence to preventative drug regimens, reducing variation between patient groups and optimising population health outcomes in other ways as these opportunities become apparent.

2. Review of the Changes

Context of NHS Changes

The NHS will devolve powers and responsibility to 42 ICSs to look after the health of the English population from July 2022. Providers, commissioners, local government, and other local stakeholders from across the health and social care spectrum will join forces to plan and deliver a strategy for health services that deliver local population health management goals. In several places these ICSs effectively already exist as ‘coalitions of the willing’ and have gained traction as especially through the shared experience and common goals of the COVID-19 pandemic.

Why is the NHS adopting this statutory integrated care model?

Lawmakers believe that a nationally led, organisationally siloed model cannot effectively serve the needs of today’s population for the following reasons:

- The NHS has a different role today in an ageing and more chronically unwell population, including working with local government on whole life course and wider determinants of health

- Poor outcomes have been accelerating in key success measures across the NHS

- Health inequalities continue to grow both within and between regions

- Health interventions are disjointed across local areas

- National guidelines do not fit local needs in many cases

- Older models of hospital-based medicine are expensive, unsustainable and probably unnecessary where care can be delivered closer to home.

An alternative is a type of local Accountable Care Organisation (ACO) model. This is a well-known structure for high-performance care systems across the globe. These fully integrated care systems may have the answer to some of these issues. In their purest and most effective form – like ICSs – they aim to:

- Provide a single system of all health ecosystem partners working together with shared goals – from local authorities to tertiary care

- Deliver more provision in the home and community including with early intervention

- Tackle health inequalities at the sourceg., with housing, employment and support

- Focus on the population place by place and what they need

- Devolve finances and decision making to the local level for local priorities.

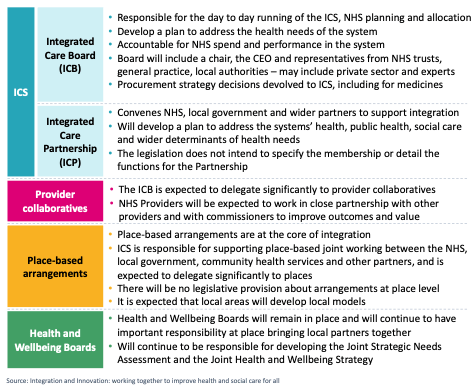

The legislation and supporting documents set out the principles that will inform the structure, purpose and expectations of ICSs. At CF we combined this with our experience of working with these nascent organisations and NHSEI to create a background view to orientate the newcomer to these high-level changes. In summary they consist of the following parts, also described in Exhibit 1 below:

- Integrated Care Board (ICB): The statutory NHS organisation responsible for the delivery of care across a territory of 1 to 3 million people led by a Chair and Accountable Officer

- Integrated Care Partnership (ICP): A group of constituent representatives from across the health and social care spectrum (NHS, local government, patient representatives, private sector etc.) in the ICS

- Places: Localities within the ICS that represent a smaller defined geography. These can be defined as the ICS wishes e.g., could be an area of local government, a provider collaborative or an area represented by a PCN, etc.

- Provider Collaboratives: Groups of providers that work together to design and deliver services. These can be organised as the ICS decides e.g., vertically – acute to community, or horizontally – across a certain set of peer organisations.

Across these areas, the new legislation seeks to create:

- Smooth integration through joint committees and appointments and collaborative commissioning approaches

- Duty to collaborate across the healthcare, public health and social care system including local authorities

- Shared duty for NHS organisations that plan services and providers of care, to realise the Triple Aim of better health and wellbeing for everyone, better care for all people, sustainable use of NHS resources

In summary, ICSs will create:

- 42 health systems of all local health ecosystem partners working together to shared goals

- A focus on the local population place by place and what they need

- Devolved decision making and finances to the local level for locally set priorities

- Data sharing across the health and care system

However, not all ICSs will be alike. ICSs have wide discretion to set their own agendas, and this will create nuance in the shape and impact of each one.

Further changes that create opportunity

During research for this work, a leader of a major Academic Health Science Network (AHSN) made an important remark: “It’s not just about ICSs: The [Government’s 2021] Life Sciences Vision, Future of UK Clinical Research Delivery, UK Innovation Strategy, ICSs, they’re all bringing change. Not many people are joining up these documents. Public private sector collaboration is writ large into them.”

Notably, the Life Sciences Vision calls on ecosystem stakeholders including the NHS and Life Sciences to build on the UK’s science and clinical research infrastructure and harness unique genomic and health data, to test, purchase and spread innovative technologies more effectively and to create an agile environment where companies can grow, manufacture and commercialise products.

The DHSC Data Strategy calls for increasing availability of data for individual care and system insight through a new duty to share, but also easier access to a large, universal set of relevant data for trials and research.

Exhibit 1: Summary of ICS Structure

Initiatives such as NHS Accelerated Access Collaborative (AAC) are focused on creating fast access to new technologies and treatments for clinicians and patients, and to support Life Sciences in helping them participate in and achieve these aims alongside the NHS.

3. Finding opportunities within this emerging NHS landscape: 20 insights with implications for Life Sciences

The imminent existence of the new ICS structures raises many questions for Life Science firms as they seek to understand the implications of this new customer landscape. Where and how – or even, should – Life Sciences engage at this level of the NHS?

On-the-ground change in the NHS can often be overstated and underdelivered. Naturally there is scepticism among some UK Life Science leaders about how substantive or impactful this reorganisation would be. In researching this work, we encountered the common view that Life Sciences engagement with the NHS happens at the top with MHRA, NICE and NHSE and then at the front-line with consultants and the multi-disciplinary teams. Collaborating with mid-level or local management has never been a focus.

However, several senior Life Science leaders hold the conviction that ICSs bring both risk and opportunity which the industry should be ahead of. One senior Life Sciences industry leader said, ‘We cannot ignore ICSs in any way, and we should be engaging with them from the start.’

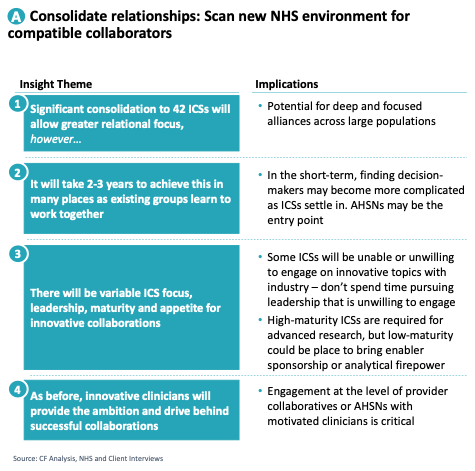

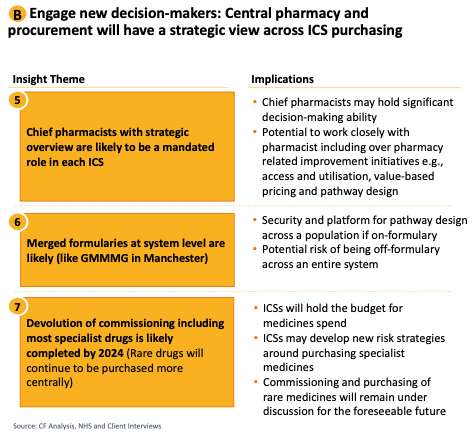

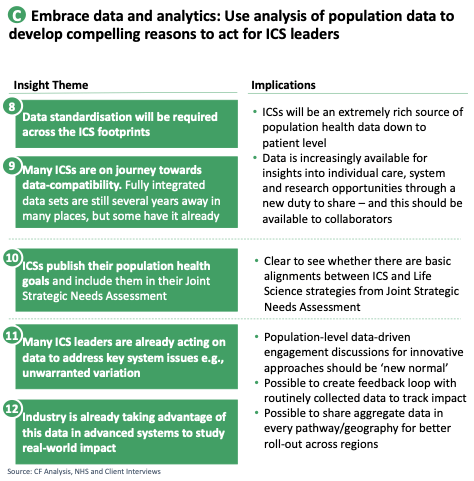

To understand the likely reality, CF spoke to more than 20 senior leaders from future or shadow-form ICSs, NHS regions and allied organisations such as AHSNs to create a better picture. These leaders described their view of both the possibilities, but also the complexity. As we listened to these leaders who are shaping this emerging landscape, we identified a set of 20 practical insights categorised into 5 areas of opportunity for collaboration. These are to:

- Consolidate relationships

- Engage new decision makers

- Embrace data and analytics

- Take a leading role in pathway innovation

- Pursue big deals around the 7 missions of the Lifesciences Strategy

Exhibit 2.

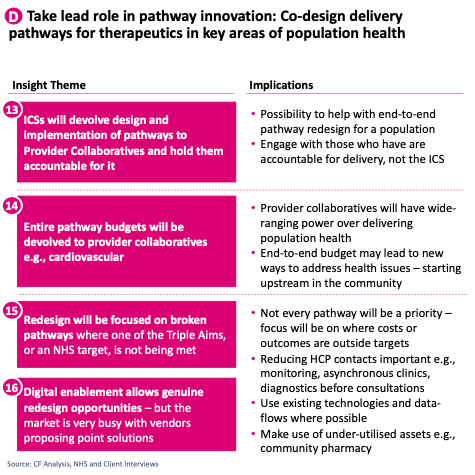

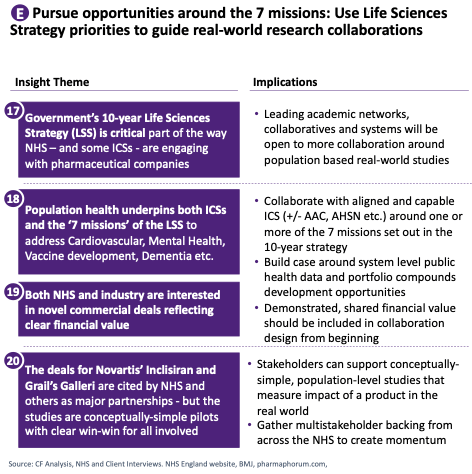

Exhibit 3.

Exhibit 4.

Exhibit 5.

Exhibit 6.

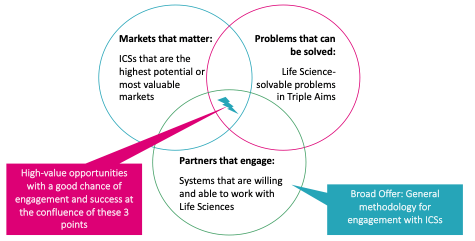

4. Focusing on the opportunities that have potential

How should Life Sciences companies respond to the more strategic collaborative opportunities described above? Which are the most important and how should they be captured? Leaders at Life Science firms must be strategic and decisive in considering which of these opportunities are priorities for them. They need a cohesive, data-driven plan for how the opportunities might fit together to create a unified and consistent approach to bring to ICS leadership.

Each Life Science organisation will have a unique approach based on the profile of their own products, capabilities, resources and reach, but all will need to be focused and targeted about where to pursue any collaborations. While there is no ‘cookie cutter’ approach, at a simple level we propose that the sweet-spot for high-value opportunities with a good chance of engagement and success for all involved can be found at the convergence of:

- Markets that matter: Being clear about where portfolio products or services and existing market presence creates a realistic ability to make a difference

- Problems that can be solved: Creating a data collection and analysis capability that enables Life Sciences companies to scan chosen markets for areas of ‘solvable’ suboptimal care such as limited access, poor outcomes or inefficient clinical pathways

- Partners that can engage: Scanning the market of 42 ICSs – and related AHSNs – to find leaders and organisations with the level of maturity, willingness and bandwidth required to engage with and commit to collaborating on transformational ideas

Exhibit 7: Seeking opportunities at confluence of 3 key elements

These opportunities will not be around every corner. But with careful study both of NHS needs at a local level and of Life Science ability to effect change in a specific area, some immensely valuable collaborations are waiting to be brought to life. For more information on how to do this effectively please reach out to [email protected] or [email protected]

[1] https://www.england.nhs.uk/five-year-forward-view/next-steps-on-the-nhs-five-year-forward-view/funding-and-efficiency/