On 1 October 2025, in partnership with exec search firm Odgers, Carnall Farrar convened senior health investors, executives and advisors to examine investment opportunities emerging from the NHS 10 Year Plan. The event featured analysis of the evolving health landscape and candid discussion of what it takes to succeed in today’s constrained environment.

Peaks and troughs are natural elements of any market cycle, but it has been some years since anyone would describe the UK health investment market as being at its zenith. Indeed, while the data is open to interpretation, 2024 was arguably the quietest year in recent memory for UK healthcare private equity activity. One of our panellists put it starkly by stating that – despite 30 investment professionals and £1bn assets under management – they completed just one transaction in 2024.

With nearly four years to the next election, (slowly) falling interest rates, a store of ‘dry powder’ across the investment world and a 10 Year Plan for the NHS in England the conditions for a recovery in deal-making activity should all be there. While the direction of travel is positive and signs in the market suggest we’re once again picking up pace the room agreed there is a long journey ahead.

The £60bn ‘Perfect Storm’

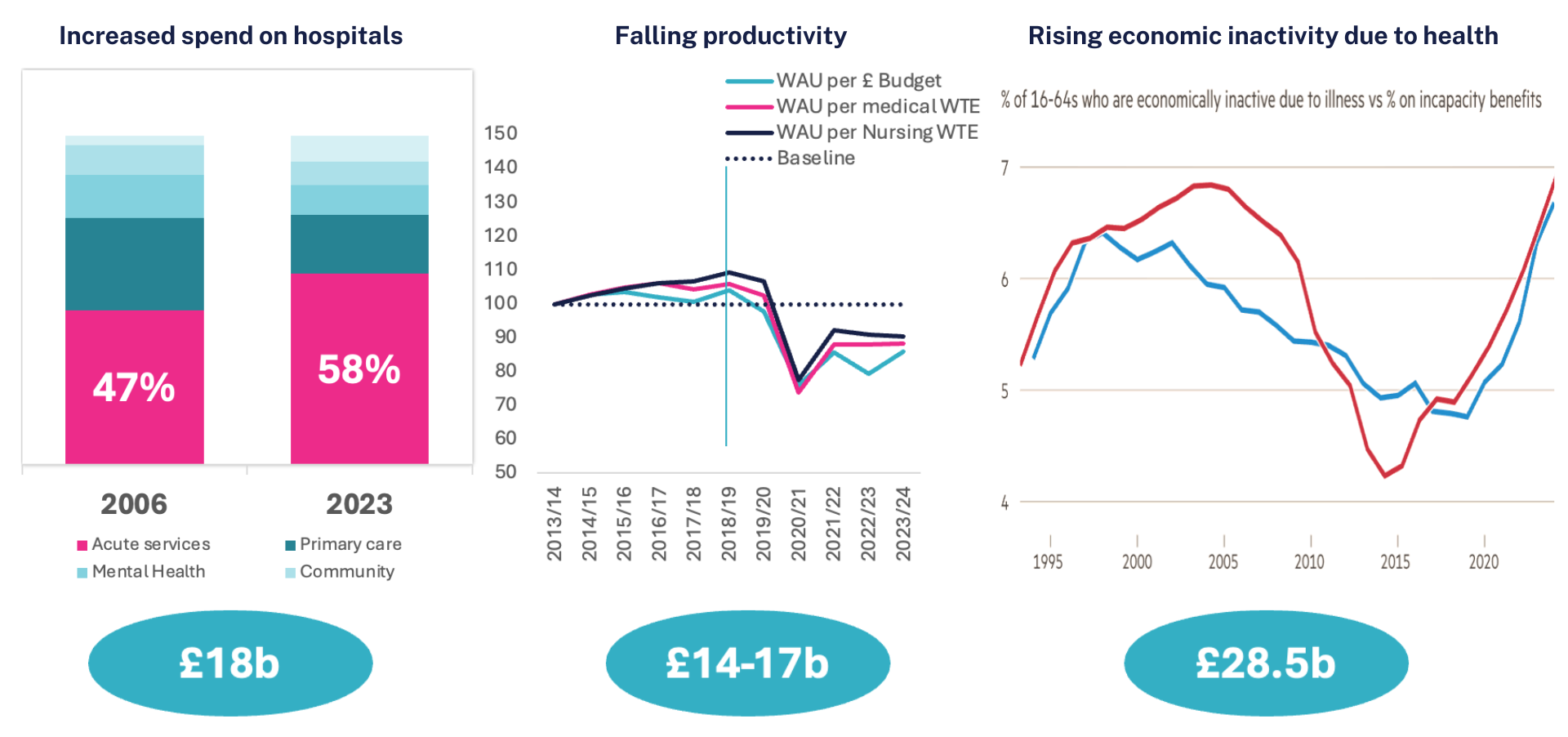

As CF’s managing partner Ben Richardson’s keynote presentation laid out, the UK health sector faces an extraordinary fiscal challenge. Despite two decades of policy aspiration to shift care into the community, the opposite has occurred. Hospital spending increased from 47% to 58% of NHS expenditure between 2006 and 2023, representing an £18bn “right drift” toward acute services.

This wouldn’t be problematic if it delivered results. But productivity has plummeted 10-14% as workforce grew much faster than activity, effectively consuming £14-17bn in value. Meanwhile, economic inactivity due to health reasons surged, creating a £28.5bn pressure through both benefit costs and lost economic output.

This has resulted in a system under profound pressure, with investors balancing the abundant opportunities for both independent sector partnership and the creation of new markets with deep concern around ability of the system to make sustainable spending decisions (as evidenced by the recent contraction of life sciences investment after government commitments evaporated post-Budget).

Source: Darzi Investigation (left), CF Value in Health: Addressing the productivity challenge in acute care (middle).

The drivers of system cost are also the sources of value

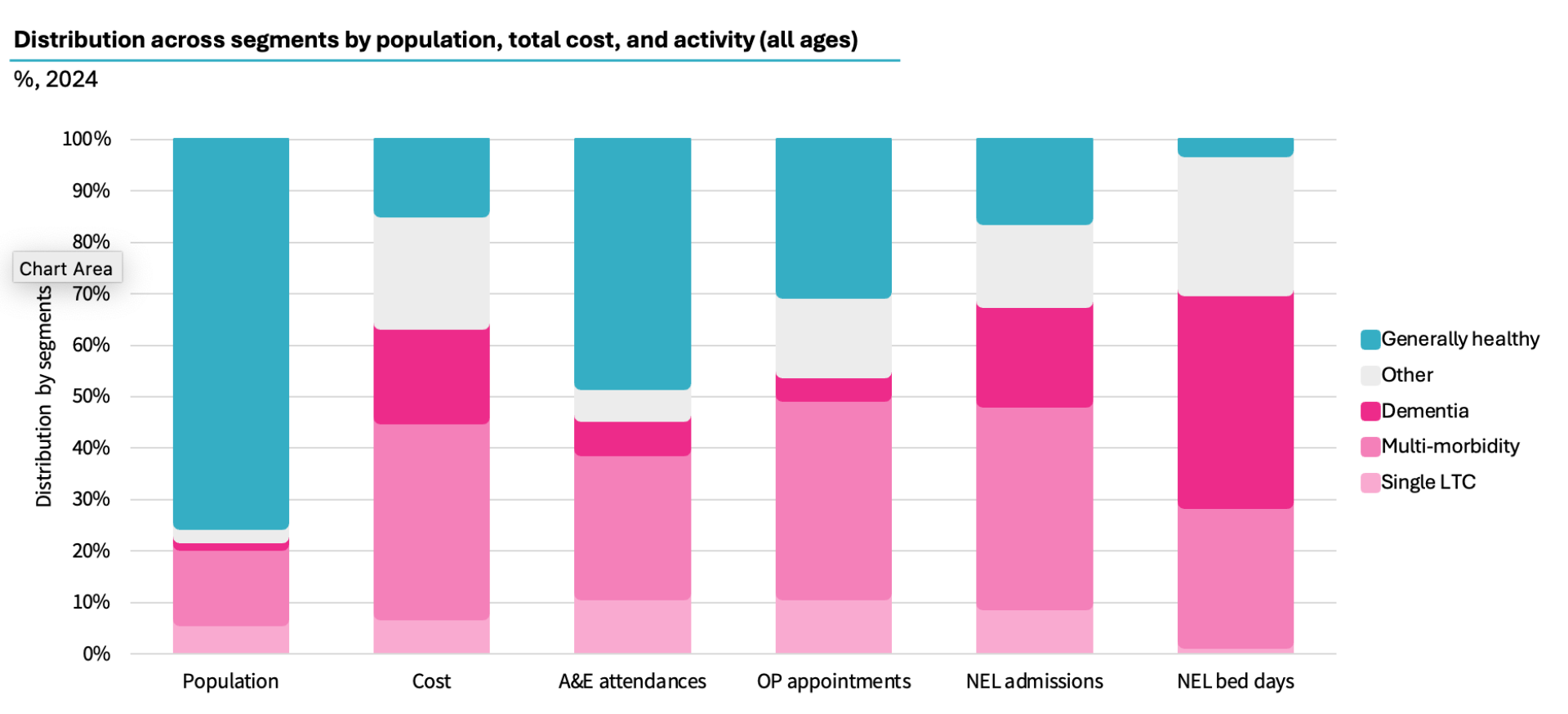

Our analysis for the NHS in support of the 10 Year Plan mapped every hospital encounter for England’s 57 million people over five years, revealing stark cost variations. Just 12.5 million people with chronic conditions drive £61bn of hospital costs – between 5x-114x the cost of generally healthy populations. Effectively identifying and intervening with these cohorts represents significant opportunities for both the system and the investment community.

Our analysis shows there are immediate actions that could positively impact variation in care. Yawning gaps exist in diagnosis and treatment: only 37% of CVD patients achieve target cholesterol levels, 28% of type 2 diabetes patients reach optimal HbA1c, and just 65% of dementia patients are diagnosed. Closing these gaps could deliver £9bn in savings from avoided hospitalisations.

Source: CF analysis

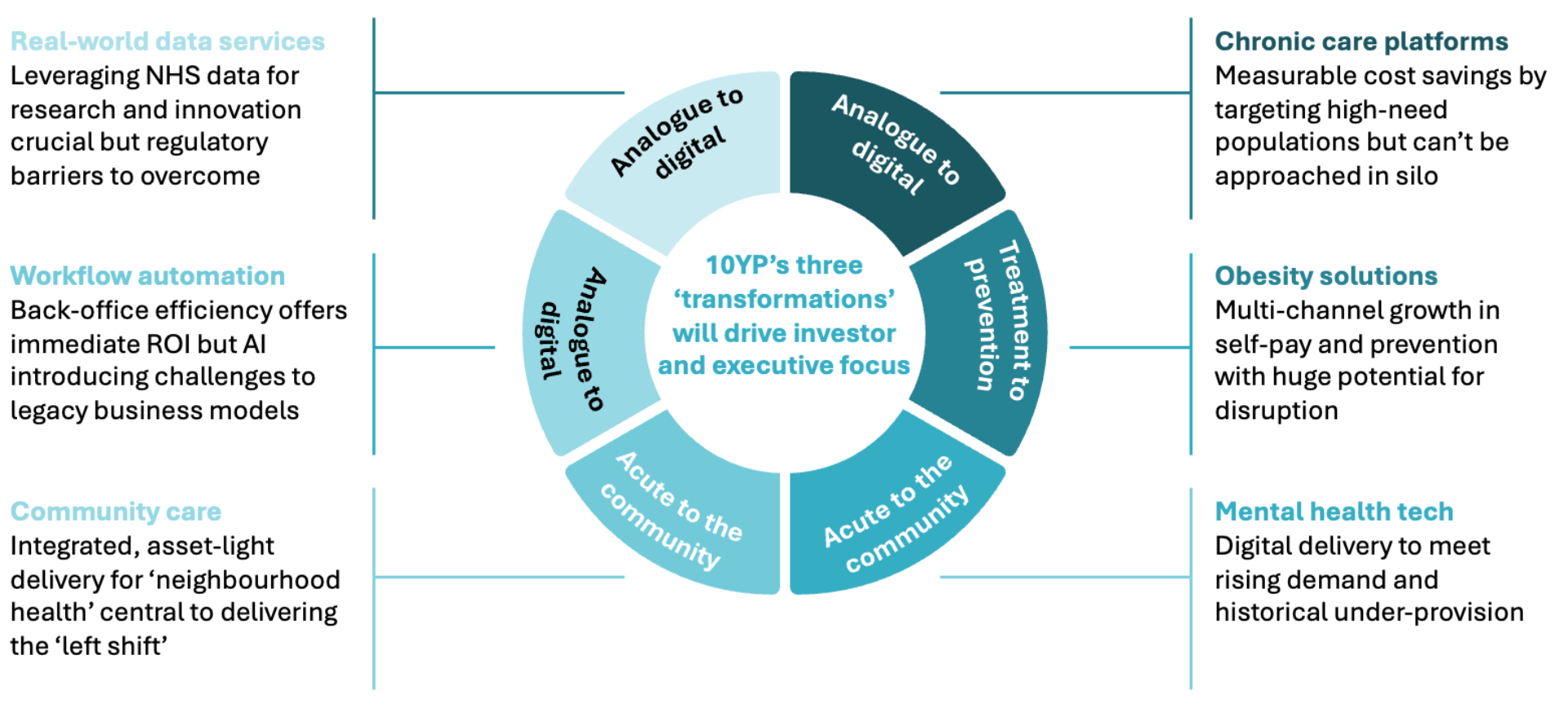

The 10 Year Plan’s three transformations – analogue to digital, treatment to prevention, acute to community – create distinct opportunities for independent providers, investors and PE portfolio companies. CF has identified a number of core investment themes: chronic care platforms, obesity solutions, mental health tech, real-world data services, community care models, and workflow automation. Commissioners’ ability to contract for these services in a sustainable manner varies considerably across the health service, however, driving longer and uncertain sales cycles.

Our previous work with the NHS Confederation ‘Paving a new pathway to prevention’ demonstrates the ROI case for preventative medicine is difficult to argue with. Our analysis of 142 prevention interventions showed a median 2x return, with the top quartile achieving 4x and some reaching 25x. Work on AI suggests up to 50% of NHS encounters could be digitally avoided. Making this a reality under current NHS purchasing cycles remains the greatest challenge for commissioners and innovators alike.

Investment panel: Cautious recovery driven by expedience, with investors required to move the market

The panel discussion (featuring Christian Dube, Charterhouse; Yasemin Arik, G Square; Tony Ball, KPMG and Andrea Kincade, Lifeways) brought together perspectives from across the investment ecosystem, revealing a market in cautious transition. After 2024 marked one of the lowest years for deal activity on record, 2025 shows recovery signs. One panellist noted seven UK healthcare deals had closed in past 12 months, with three more in exclusivity, but cautioned: “The market is still very discerning. No deal walks itself over the line.”

Hold periods have extended from 3-5 years historically to 8-10 years today, creating pressure to recycle assets and demonstrate liquidity. What one panellist called “zero loss ratio” investing – funds delivering 2.5x+ returns consistently without losses – has become the LP standard.

Another panellist observed that “the last 18 months has been very strong for M&A into existing portfolio companies” – backing known management teams in proven assets remains easier than pursuing new platforms. “You have to keep the flow going,” they noted, “otherwise you don’t get new investment into private equity in the first place.”

The year of the ‘non-process process’

A defining characteristic emerged in relation to transactional behaviour in the marketplace: “It’s been a year of the non-process process. I’m not in a process, but I’ll have a conversation with you. Before you know it, you’re in a process.”

Assets coming to market after extended hold periods must understand their value creation story and match it to the right capital pool, the panel advised. “Not every asset will appeal to every investor. You really need to understand what the value creation has been and match that with the investor community you’re trying to tap into.”

The message was clear: start building relationships and crafting your narrative well before any formal process.

Automation for the people: avoid “AI for AI’s sake” at all costs

Technology emerged as critical but nuanced factor. One investor explained their firm has an operating partner responsible for digital and AI across their portfolio, but panellists united in rejecting “AI for AI’s sake.”

“Just hiring a team of people responsible for AI won’t give you credit for that. It needs to be integrated into the operations through a smart way of building that into delivery.”

Digital enablement is seen as a wider opportunity for investors, spanning back-office efficiency, unified data systems, and integration into clinical delivery. For technology businesses, this becomes part of the equity story. For traditional service providers, it’s becoming the minimum expectation to have such systems in place ahead of a process. for exit readiness.

To learn more about CF’s work in Data, Digital & AI including our work on Lord Darzi’s Future State Programme work, click here.

The commissioning conundrum

A pointed exchange highlighted tensions between independent sector delivery and NHS commissioning. One participant asked: “What does it take to convince government that it needs to be a reliable contracting partner?” They described delivering an elective recovery programme with private investment, only to face a 19% tariff reduction.

One panellist acknowledged: “Healthcare is not alone in that regard. The government has its own political cycle. There’s enough support out there for anti-profits coming out of NHS.” They noted capacity constraints require outsourcing, but added: “The truth is there’s always going to be a bit of a peak and trough, and for an investor, you’re going to have to budget for it.”

Another noted the political reality: “No politician wants to stand up and say I’m going to privatise the NHS, even though Labour probably had the biggest movements towards privatisation in the 2000s. You have to go and market directly, show that you’re going to provide a service the NHS is unable to provide or provide it quicker.”

As one panellist said: “There are some good signs in terms of where the NHS wants to go, but in reality, investors are having to look increasingly at investing also in private provision for private pay. It’s very difficult to back an NHS story purely on NHS.”

For investors and executives alike, the UK healthcare story currently is one of great opportunity but significant complexity. Building strategies based on data and deep sector understanding, combined with an iterative approach and long-term vision, remains the best plan to follow.

About CF

CF is a leading consultancy dedicated to making an enduring impact on health and healthcare. We work with leaders and frontline teams to improve health, transform healthcare, drive adoption of innovation and create value through investment.

About the authors

Vernon Baxter

Vernon is an Associate Partner at CF and has an extensive background in the UK’s health and social care investment market. He has covered UK M&A activity for 15+ years, convening major industry events and developing deep expertise in the sector. At CF, he has led projects involving commercial due diligence, value creation, impact validation and the baselining of services for independent providers working with the NHS. Vernon previously led Investor Publishing and HealthInvestor UK for over a decade

Ben Richardson

Ben is Managing Partner at CF and works at the intersection of health systems and life sciences in the application of health data to create insights, enable intervention and generate evidence. He is an expert in population health, the uptake of innovation, real world evidence and the economics of health. Ben leads CF’s Life Sciences and Health Investing practices and Data Sciences capability.