How the NHS can optimise health outcomes in a time of financial constraint

There is growing consensus that the NHS is at a turning point. Despite absorbing an increasing share of public service spending, performance is stagnating or in decline, while public expectations and health needs continue to grow. The 2024 Darzi Report labelled the NHS as “in serious trouble”—a conclusion that underscores the urgent need to re-examine how the system delivers care, how it uses its resources, and how it can be set on a path toward sustainability.

In other words, the NHS needs to consider how it can increase healthcare value to deliver better outcomes and greater output from the available funding. Delivering more from existing resource This means boosting productivity across the system, using resources more effectively to meet the health needs of the population, and investing in prevention to improve health and reduce long-term costs. Together these things need to be possible for the NHS to be sustainable.

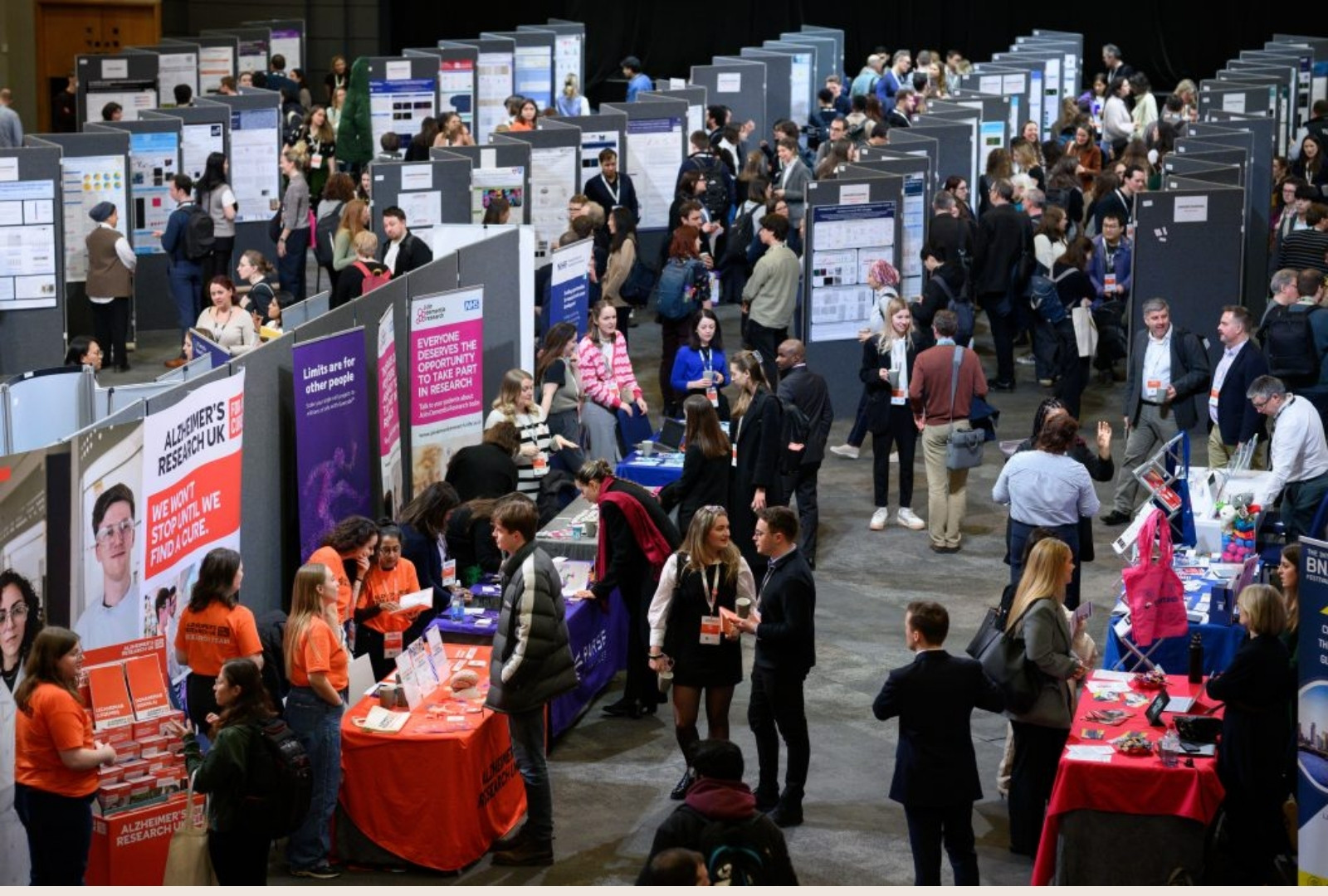

At a time when public trust and political focus on the NHS are sharper than ever, our latest report, aims to answer these questions and considers how the NHS can increase healthcare value.

Over this ‘Value in Health’ series, we aim to address the following:

- What is the size of the productivity opportunity in the NHS overall and what is driving it?

- What is the size of unmet needs in chronic conditions, and what is the potential impact of closing these gaps through improved care and treatment?

- What is the opportunity for improved return on investment of prevention?

- What are the critical enablers to permit this to happen?

This introduction provides the context of our analysis and a high-level summary of the findings.

The paradox of the ‘Left Shift’

For over two decades, political and policy ambition has centred on what has been variously described as integrated care, care closer to home and population health management, which some have labelled a “left shift”. The government’s focus on “three shifts” prevention, community-based care, and digital innovation aligns with its long-term policy objectives.

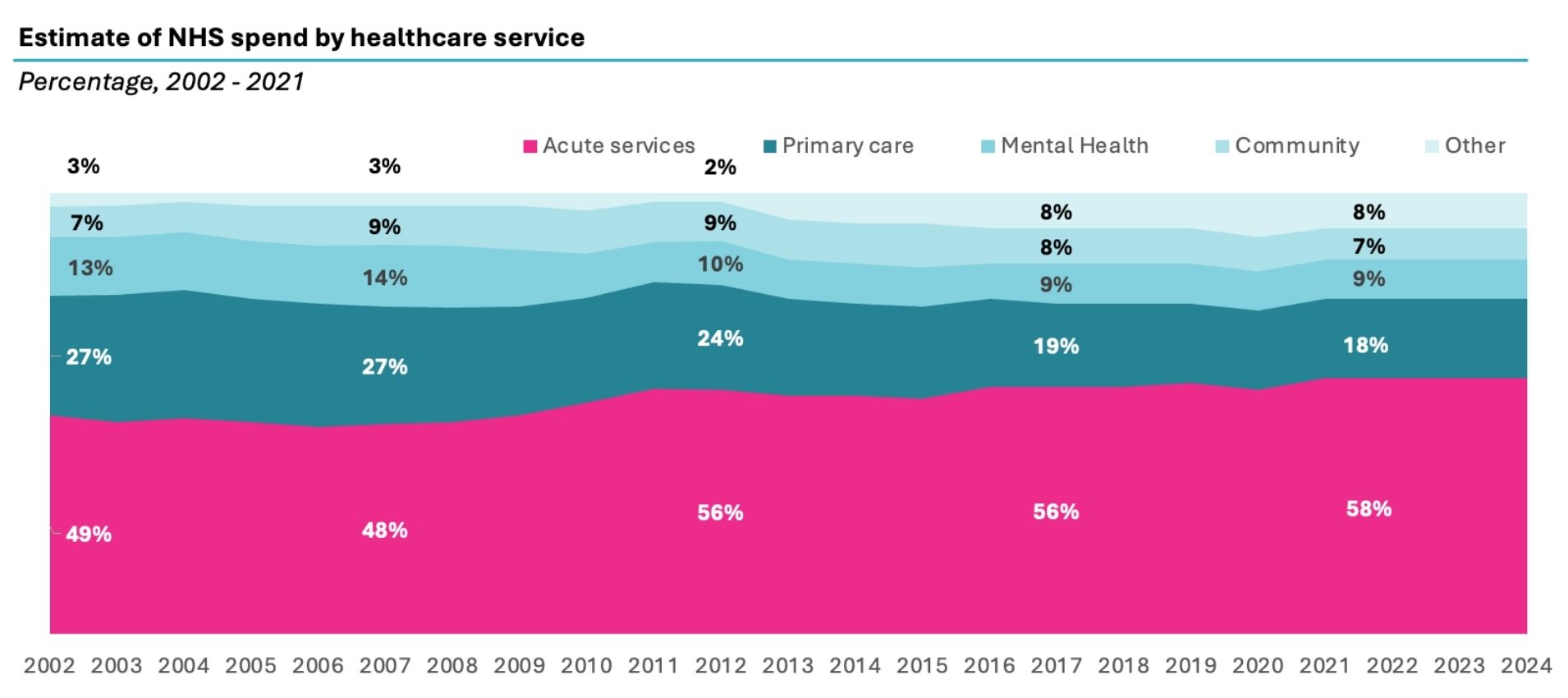

In practice, however, the Darzi Report highlights a persistent “right drift.” Acute hospital care now consumes 58% of NHS spending, up from 49% in 2002, while investment in community and primary care has flatlined or declined. This imbalance has starved the parts of the system most capable of preventing ill health and managing chronic conditions, which in turn feeds more demand into the acute sector.

At the same time, the health of the population has deteriorated, and the system’s ability to commission services effectively has weakened. The result is a self-reinforcing cycle of rising demand, reactive spending, and declining returns on investment (ROI).

Source: UK House of Commons Research Briefing: NHS funding and expenditure (2024), Populations data is from ONS. Spend by care setting is taken from Darzi report (2024).

To address the issues identified in the Darzi Report of declining health despite the rise in spending, we wanted to investigate what has happened to NHS productivity on the one hand and how the health of the population is being addressed on the other. In doing so we have looked at 3 key themes; NHS productivity, the unmet needs in chronic conditions and the return on investment from prevention spending.

Given the concentration of funding in the acute sector we have focused explicitly on acute sector impact in these three areas. To make this report as robust as possible we have relied on figures reported by NHS England itself and submissions to parliament, using annual figures for spend, activity and workforce.

Key findings

1. The productivity challenge in acute care

In looking at overall NHS productivity, we found that the acute sector stands out as the area where productivity has fallen most significantly—despite being the largest and fastest growing area of NHS spending. In contrast, primary care has increased output relative to input and mental health and community care appear to have broadly kept pace.

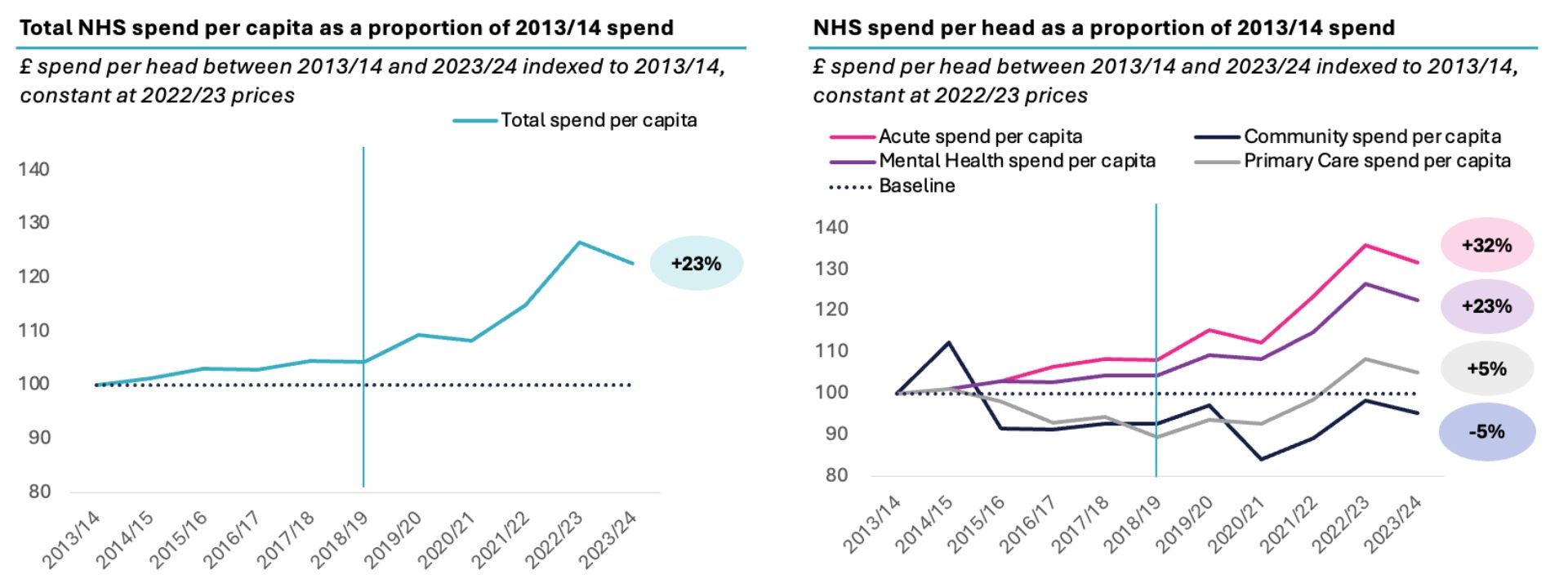

Between 2013/14 and 2023/24, NHS spending per capita rose by 23%, with spending in the acute sector increasing even more sharply—by 32%. However, this rise in funding has not delivered the expected improvements in output; in fact, productivity has significantly declined. The core issue is that much of the additional funding has gone toward expanding the workforce—particularly doctors and nurses—at a rate far exceeding long-term demand growth, while output has fallen and remains below trend.

Source: UK House of Commons Research Briefing: NHS funding and expenditure (2024), Populations data is from ONS. Spend by care setting is taken from Darzi report (2024), 2021/22 – 2023/24 splits are assumed to 2020/21 proportions documented in Darzi. Between 7-10% of spend categorised as ‘Other’ and not attributed to any care setting.

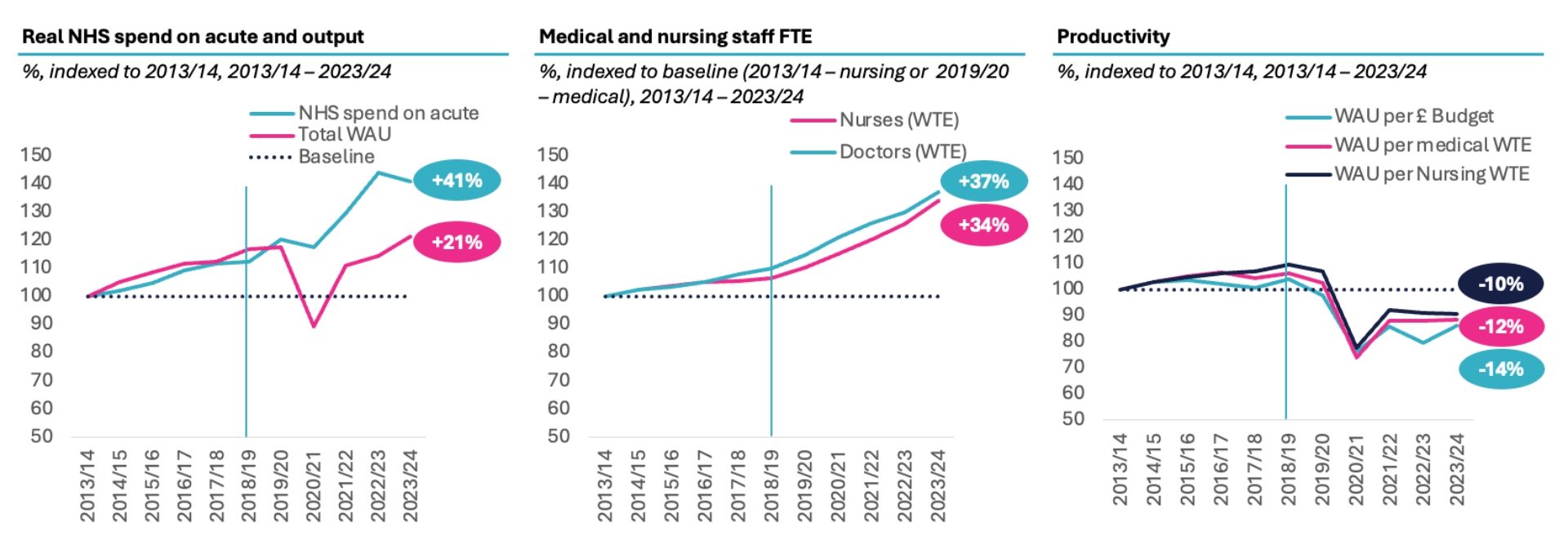

Although acute care productivity improved in the early 2010s, it began to deteriorate from 2018/19—one year before the pandemic—and has yet to recover. Over the past decade, real spending rose by 41%, and the workforce grew by 34–37%, but output increased by only 21%. Hence, over the past decade, productivity in the acute sector has dropped by 10–14% since 2013/14.

In 2018/19, a notable shift occurred with the annual growth rate in the number of doctors and nurses accelerating to 2.3x and 3.7x higher, respectively, than in the preceding five years—despite little evidence of a corresponding rise in activity or outcomes.

Source: CF Analysis of Hospital Episode Statistics, KH03, ONS, Unit Cost of Healthcare, NHS workforce statistics, NHS Funding and Expenditure, Darzi report [1].

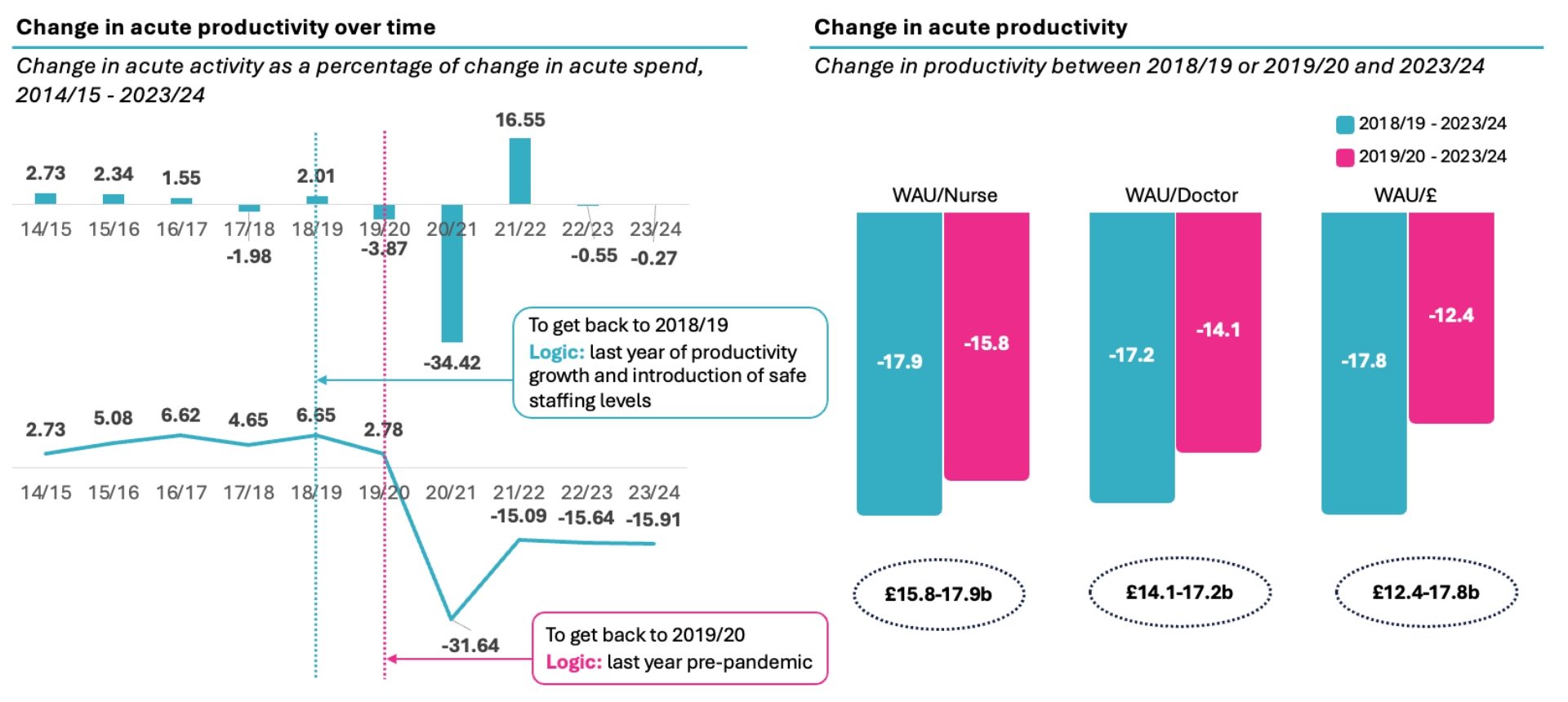

Our analysis shows this productivity loss amounts to £17b to £18b since 2018/19. This loss in acute productivity since before Covid in 2019/20 to 2023/24 is estimated to be 12-16%. However, productivity had already started to fall in 2019/20 before Covid. Thus, we measure productivity’s decline from when started to fall in 2018/19 as a drop of 17-18% whether measured as weighted activity unit per nurse, doctor or pound spent on the acute sector.

Source: CF Analysis of Hospital Episode Statistics, KH03, ONS, Unit Cost of Healthcare, NHS workforce statistics, NHS Funding and Expenditure, Darzi report [2].

NHS England reported its view that productivity had fallen 24% in 20/21 and had grown 2.4% in the first seven months of 24/25, concluding productivity was about 8% lower than in 19/20, due to a set of adjustments noted although with data that is not in the public domain [3].

If we backed up the clock to the level of productivity in 2018/19 and banked the 17-18% productivity gain, the £17b reduction in acute spend would reduce the acute share of the NHS budget to 49%. In other words, it would entirely reverse the “right drift” since 2003. And it would make an “acute productivity dividend” of £17b available for reinvestment in primary care, community care, and mental health.

To capture this opportunity, we must boost clinical workforce productivity:

- This starts with an economic review of safer staffing models to review the guidelines being operated within and whether the benefits of these is worth the cost.

- Address the mismatch between clinical workforce growth and patient demand by leveraging granular data on activity and staffing at both the provider and system level. Localised workforce planning should be introduced to ensure clinical capacity is better matched to actual patterns of patient need.

- Create incentives for providers and potentially staff by ensuring the money follows the patient. Activity based payment across the board is needed to enable funding of activity, remove distortions from block funding, and provide a basis for value-based models on top of the baseline of counting of activity.

- Data, digital and AI should be embraced to accelerate this. The FDP could enable replicable analysis to scale workforce productivity across the country and deploy AI tools that reduce admin, particularly through natural language processing and intelligent agents, freeing up clinicians to focus on patient care.

2. Unmet care gaps in the treatment of chronic diseases

As the Darzi Report made clear, the health of the population has declined. Given the scarce resources faced today, is the cost effectiveness of interventions being maximised? Hence, in our report we focus management of chronic disease and the impact of optimising treatment in line with clinical guidelines.

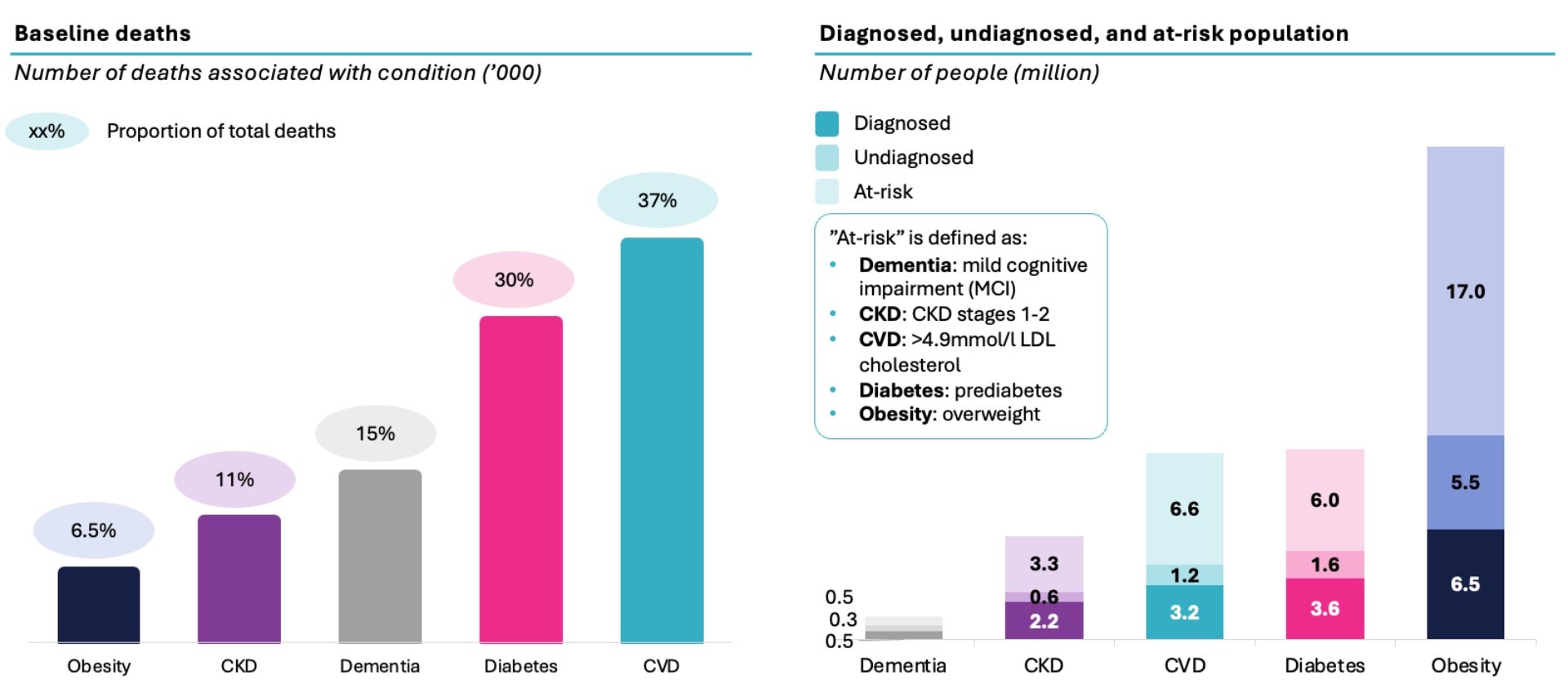

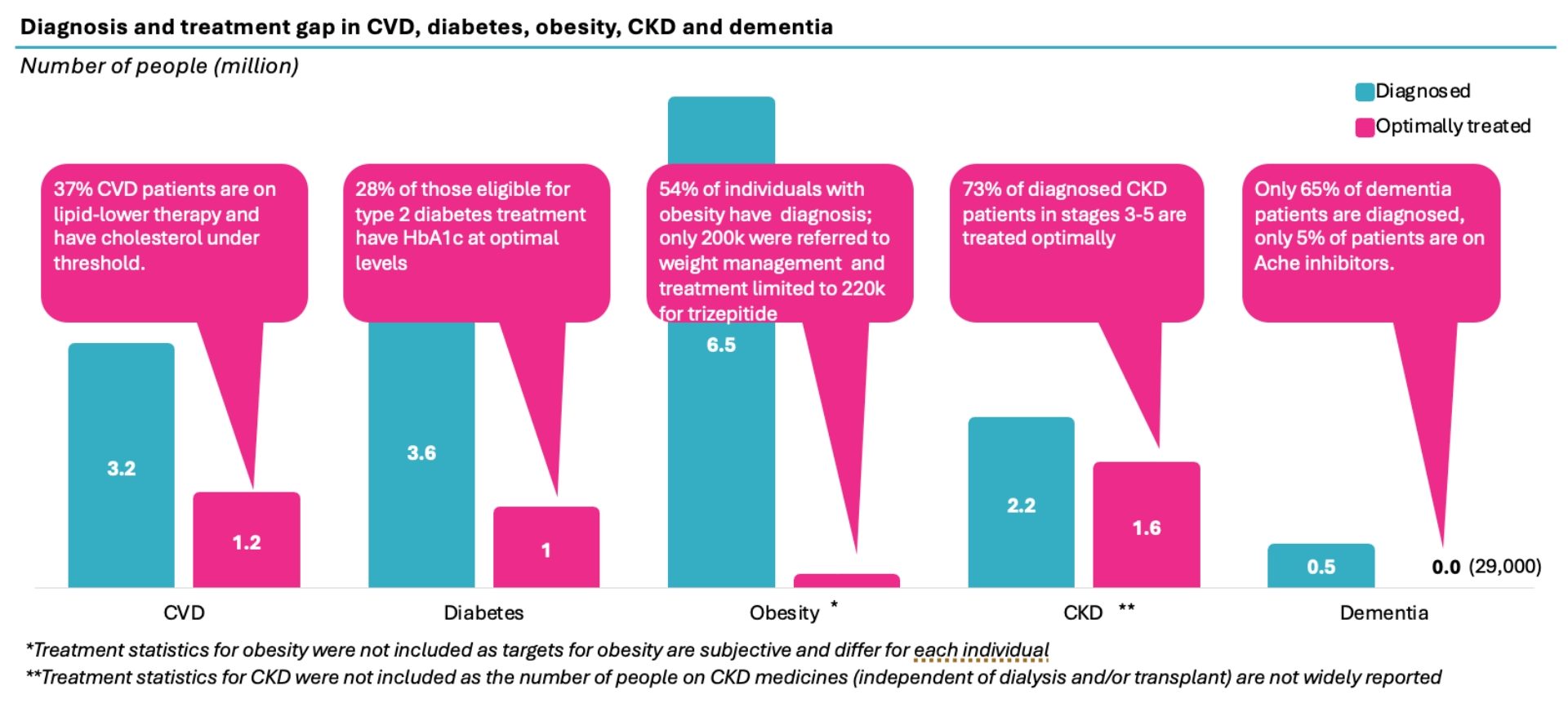

Cardiovascular, Renal, Metabolic (CRM) conditions including CVD, Chronic Kidney Disease (CKD), diabetes, and obesity are increasingly recognised as a related set of diseases which are also connected closely with onset of dementia. Together they are associated with up to 37% of deaths each year. Looked at independently, each of these affects between close to 1 million (dementia) to more than 6 million (obesity) who have a recorded diagnosis within clinical criteria. Independent estimates of prevalence put the burden as significantly higher, but critically, beyond those already diagnosed, there is a substantial undiagnosed and at-risk population. If left unaddressed, the burden of disease will continue to grow.

Source: CF analysis, Diabetes UK, British Heart foundation, Alzheimer’s Society, NHS England, QOF, Gov.uk, ONS, Kidney Research UK, CVD Prevent [4].

In addition to heart attacks, strokes and deaths from largely preventable disease, chronic disease places an increasing strain the system, especially the acute sector, with increased A&E attendances, emergency admissions and outpatient appointments. It has been complicated to understand the precise burden of these conditions together due to the substantial comorbidity of disease—and previous attempts to do so have used subsets of the population or estimates.

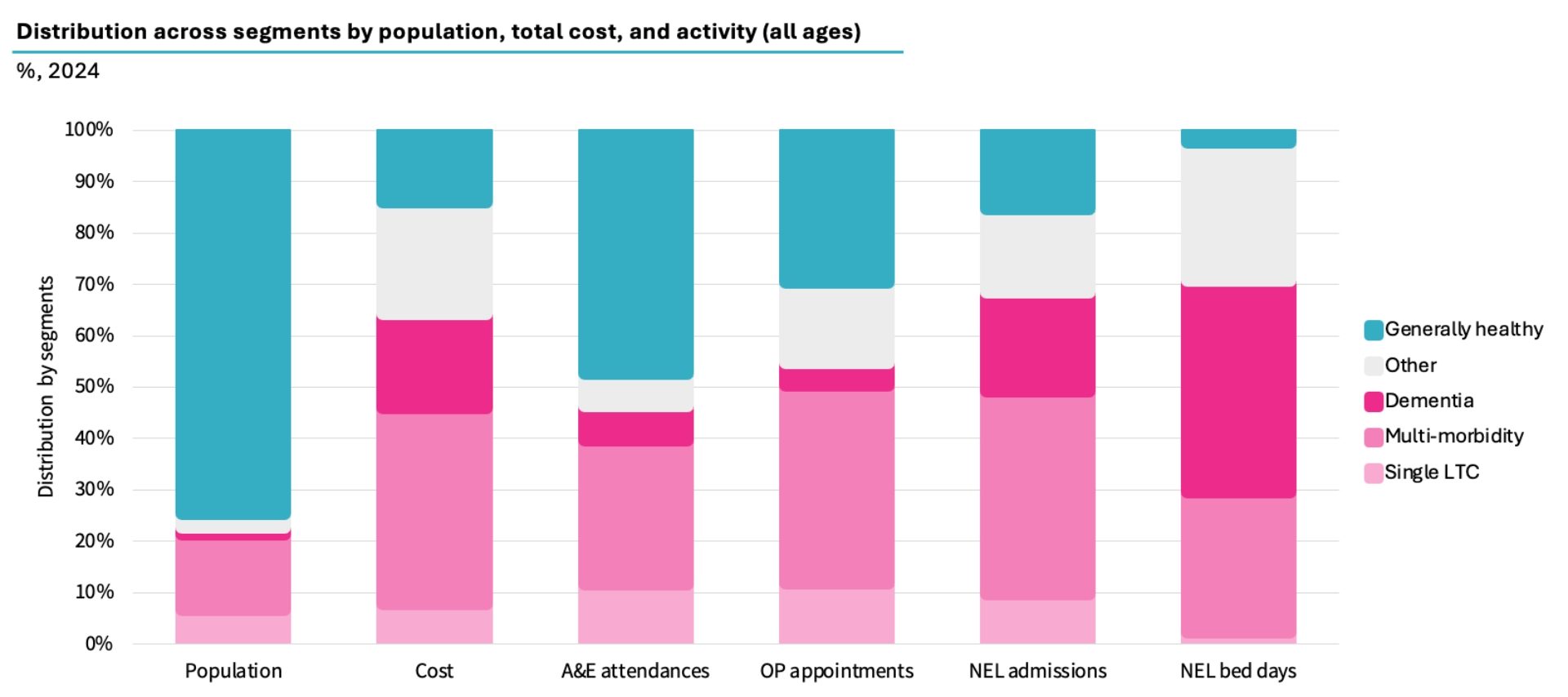

In new analysis of record-level data of the whole population, we find that individuals with a single long-term condition make up 6.8% of the population and account for 7.9% of NHS acute costs, while those with multimorbidity represent 15% of the population but drive 39.7% of acute costs; together 22% of the population drive 48% of costs.

Meanwhile, while dementia affects just over 1% of the population yet accounts for 10% of acute spend.

Within this set of people, we analysed four major chronic conditions—cardiovascular disease, diabetes, chronic kidney disease, and obesity—as well as dementia. These conditions represent these represent a growing spectrum of CRM conditions. CRM accounts for £52 billion or 50% of the chronic disease burden and 56% of acute healthcare cost, with dementia contributing an additional £8 billion, for a total of £34b.

Source: CF Population Segmentation using analysis of ONS, Hospital Episode Statistics record level data, National Cost Collection Index, MFF [5].

In theory, the NHS is well positioned to manage these conditions: NICE has developed world-leading guidance on cost-effective care in all five areas. But in practice, there are large and measurable gaps between expected prevalence and what is diagnosed, treated, and optimised. These gaps that must be closed to better meet the needs of the population.

Our analysis revealed that only 37% of people with cardiovascular disease have cholesterol below target and only 28% of people with diabetes are at the optimal level of blood sugar control. Less than 20% of CKD patients receive medication, moreover, stage 1 and 2 are not addressed by NICE guidance and as a result are overlooked. In obesity and dementia, most of the eligible population do not even receive treatment. 65% of dementia patients are diagnosed and only 5% of patients are on AcHe inhibitors which has been shown to delay admission to residential care by up to 2 years. Moreover, recent evidence suggests that 45% of risk factors of dementia are addressable and hence dementia could be prevented largely by addressing the same CVRM risk factors [6].

Sources: CVD: CVDPREVENT, Health Survey England; NHSBSA; British Heart Foundation; Diabetes: QOF, NHSE, ONS; Obesity: Gov.UK, QOF, National Obesity Audit; CKD: Kidney Research UK, QOF; Dementia: NHSE Primary Care Dementia Data, DiscoverNOW, QOF, CF analysis.

To accurately quantify the opportunity, it is important to account for the high level of comorbidity across these conditions. Therefore, we have analysed segments of the population; people with single long-term conditions, those with multi-morbidity, and those living with dementia.

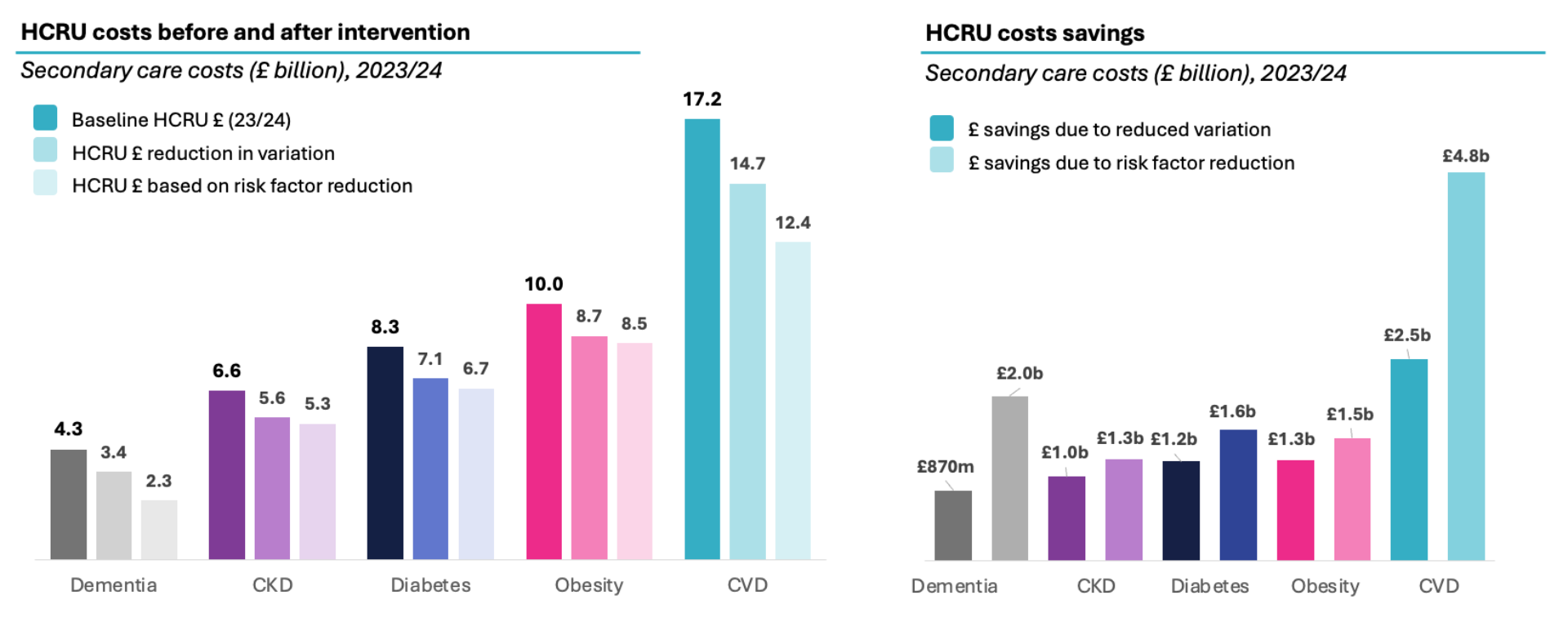

Our analysis shows that optimising treatment has the potential to reduce HCRU costs and mortality across the five health conditions with potential gross savings between £870 million to £4.8 billion, and that is before considering any longer-term impact from heart attacks, strokes etc. This used two different methods: 1) variation analysis within similar conditions, controlling for age and deprivation, and 2) risk reduction based on the achievement of clinical guidelines and reducing underlying drivers of disease.

Source: HES APC, ECDS, OP; CF analysis; CVD: NHSE, ONS, CVDPREVENT, Health Survey England; Diabetes: BNF, NHSE, QOF, ONS, diabetes.co.uk; CKD: Kidney Research UK, CVDPREVENT, Ku et al. (2018); Obesity: GOV.UK, QOF, Jensen et al. (2024); Dementia: QOF, Zuin et al. (2022), Xu et al. (2021), Davis et al. (2018).

While these opportunities here cannot simply be added, applying the average gross opportunity rate of 15% (for the variation method) to 29% (based on risk reduction) to the total £34b spend on CVRM and Dementia would be worth £4.7-9.0b. Extending the rate of CVRM savings to non-CVRM chronic conditions would take the total to £6.7 to £12.3b in total. This does not include reinvestment costs to capture these. Allowing 25-50% reinvestment costs would produce net opportunity of £3.4b-£5.0b at from pure variation and £6.1-£9.2b based on the implementation of clinical guidelines.

Addressing this will require:

- Data-driven, protocolised care: Implementing NICE guidelines through the use of linked, patient-level data to systematically identify and close care gaps.

- Population health management approaches: Shifting investment towards primary care, community services, diagnostics, general practice, and prescribing—to reduce downstream acute costs. This will require:

-

- Initiating and scaling targeted programmes

- Commissioning models that support proactive management

- Strong partnerships between the NHS and the life sciences sector

- Optimising medicines use: Aligning prescribing with national best practice to ensure patients receive the most effective, evidence-based treatments.

3. Prevention pays – but it’s underused and undervalued

Prevention is rightly positioned as a priority for both the NHS and the government – but in practice, spending on it is poorly tracked, and its impact is rarely evaluated through a return-on-investment lens. This has led to a conundrum: a strong policy desire to pursue prevention, met with a widespread perception that there is no additional money to fund it – even if prevention does save money.

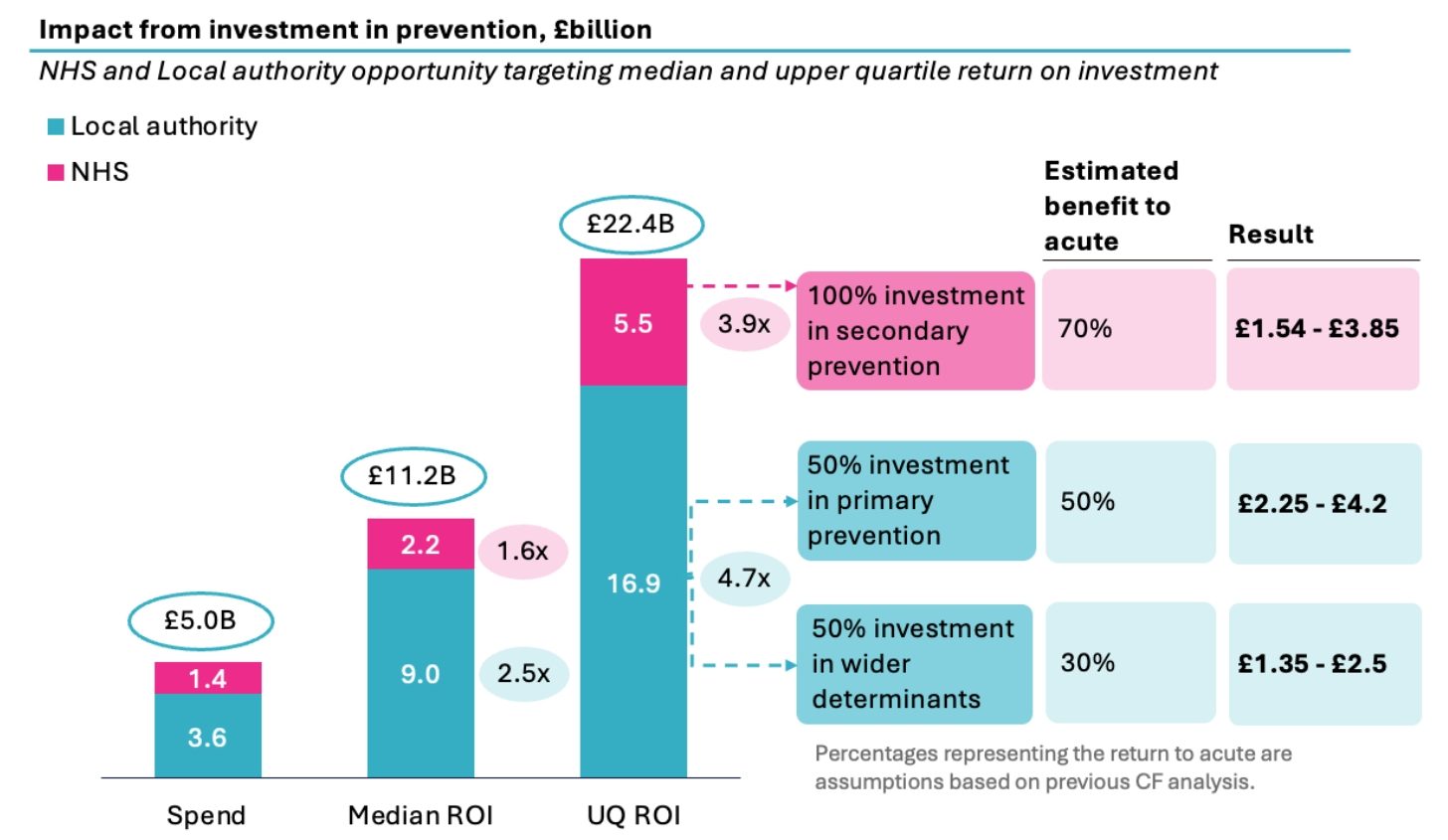

We have previously published with NHS Confed that there is a wide variation in return on investment in prevention, from 0 to 34x. The median return from prevention is 2x and the upper quartile is 4x, which suggests that better decision making about prevention could raise the return even without any increase in funding. If current mandated prevention spend – estimated at £5 billion per year – were redirected to higher-performing interventions, it could yield an additional £11 billion in value. Capturing these gains will require targeted investment in diagnostics, prescribing, and community-based care, especially in primary care and pharmacy services.

However, there is a persistent narrative within government and the NHS that potential savings from prevention are not “cashable” by the NHS. Ironically, the main concern expressed in the literature on economic impact of prevention is the reverse: that the main opportunities captured and quantified are ONLY from the acute sector and the significant reduced carer burden (e.g., dementia), increased productivity (e.g., mental health), and reduced criminal justice (e.g., substance misuse) are ignored.

Secondary prevention (managing existing conditions) tends to generate savings mainly within the acute sector. This includes the potential of significant savings from emergency admissions (cardiovascular, diabetes, vaccines, alcohol and substance misuse, falls prevention). Primary prevention and interventions targeting the social determinants of health (such as diet, physical activity, employment, and housing) tend to deliver some wider benefits including to local government (through criminal justice, higher productivity, decreased benefits due to economic participation) but many of these also deliver benefits from avoided hospital contacts.

Updating our previous analysis to take account of where the benefits fall suggests that the acute sector would receive £5.1-10.5b of the posited £11-22b opportunity from improved investing in prevention. We have assumed 70% of secondary intervention, 50% of primary intervention and 30% of wider determinants benefits the acute sector.

Source: CF Analysis, CF and NHS Confed, Pathway to Prevention (2024).

Previous analysis of ROI showed that in 2024/25, £3.6 billion was allocated to the local authority public health grant, while the NHS directed £200 million toward health inequalities and £1.2 allocated under the Section 7A of the NHS Act 2006 that requires health and justice services to meet national targets and unique indicators.

Engagement with key leaders indicates that the NHS prioritises secondary prevention while local authorities focus on primary prevention and social determinants of health (SDOH). Therefore, we have shown here the NHS prevention spend being targeted at secondary prevention and Local authority prevention spend being split between primary prevention and wider determinants.

Whatever the level of savings being targeted, the fact that the median ROI is 2x and upper quartile 4x, suggests it is reasonable to invest 25% to 50% of the expected savings from these initiatives in order to achieve the benefits of prevention.

Given advances in data, digital infrastructure, and AI enabling earlier disease prediction and intervention, it is reasonable to expect higher returns than those reflected in current ROI analyses. The case for prevention becomes even stronger when factoring in these emerging capabilities.

To fully realise this opportunity:

- We must invest smarter in prevention. Currently, what is spent on prevention is poorly tracked, and return on investment is seldom evaluated. There is a pressing need to quantify existing prevention spend, reallocate budgets based on the highest-value interventions.

- Commissioning must evolve. Investment does need to be made in areas outside the acute setting to deliver proven interventions, including in primary care, community pharmacy, community services, and prescribing – and savings need to be identified and captured from the acute sector. But to build confidence in this model, we must be able to measure outcomes – and align incentives through robust payment mechanisms.

- Activity-based payments and value-based incentives are critical not only for driving productivity, but also for enabling the capture of expected benefits from avoided activity in the acute sector. Value-based care mechanisms can sit on top of this baseline.

What Needs to Change:

Realising the potential of £12–18 billion in acute productivity gains, £3.4–5.0 billion from reducing variation in chronic disease management, and £6.1–9.2 billion by addressing care gaps could collectively unlock £15–27 billion in opportunities to improve resource utilisation within the acute care sector alone. Note this does not add in the savings that might accrue to the acute from optimised prevention spending as in many ways this would overlap with the notion of closing clinical care gaps and/or reducing variation. This would, be a substantial prize to capture and not one that could be achieved overnight.

To realise this opportunity across productivity, treatment, and prevention, we must focus on the priorities previously mentioned—supported by five core enablers.

Priorities

- Boost clinical workforce productivity by reviewing the cost-effectiveness of current staffing models, matching workforce to level of demand, implementing activity-based funding, and leveraging digital tools and AI to reduce administrative burden and free up clinical capacity.

- Set “left shift” strategy to focus on protocolized care to close gaps, shifting investment toward proactive population health management and optimizing medicines use by aligning prescribing with national best practices.

- Investing smarter in prevention by accurately tracking and reallocating funds to high-value interventions, evolving commissioning to reinvest savings through measurable outcomes and aligned incentives, and adopting activity-based payments to drive productivity and unlock value from unmet care needs.

Realising these priorities depends on five core enablers:

Together, these priorities and enablers offer a roadmap for a more efficient, equitable, and sustainable NHS—one capable of delivering better outcomes within its financial constraints.

The Bottom Line

Despite unprecedented funding, Darzi’s investigation made clear; NHS performance is falling short of expectations. But this is not inevitable. There is a £15-29 billion opportunity within our grasp—if we are willing to shift strategy, invest smarter, and tackle the root causes of inefficiency and illness.

This series will go on to explore in depth:

- Part 1: How we reverse the NHS’s productivity decline

- Part 2: How chronic diseases are draining the NHS—and how to close the care gap

- Part 3: Why prevention isn’t just the right thing to do—it’s the smart investment

Stay tuned, and follow the series: #ValueInHealth.

If you would like to discuss this report in more detail, please contact our team.

About CF

CF is a leading consultancy dedicated to making an enduring impact on health and healthcare. We work with leaders and frontline teams to improve health, transform healthcare, embed life science innovation and boost growth through investment. With unmatched access to UK healthcare data and award-winning data science expertise, our team are a driving force for delivering positive and meaningful change.

About the authors

Ben Richardson

Ben Richardson is a Managing Partner at CF, leading Life Sciences and Data Innovation. With two decades of experience, he has worked with health systems and life sciences companies globally, focusing on strategy, transformation, and development. Ben has contributed to primary care, diabetes, cardiovascular, cancer, mental health, and population health management. Since 2014, he has helped CF become an award-winning healthcare company in management consulting and data services.

Yemi Oviosu

Yemi is a Senior Manager at CF with a PhD in Cardiovascular Biochemistry, specialising in strategy and scaling innovation for healthcare and life sciences clients. He focuses on evaluating and implementing digital technologies that enable population health management and driving sustainable, enterprise-wide transformation. His unique blend of scientific insight and technology-strategy expertise helps clients accelerate innovation, de-risk investments, and improve patient outcomes.

With special thanks to Elise Kearsey, Beena Mistry, Colette Russell, Lali Sindi and Gauri Patel.